Our History

For more than a century, the Williams name has been associated with energy, innovation and trust. We have a long history of building and operating facilities that move safe, affordable, reliable energy sources that heat and fuel the nation’s clean energy economy. We take a long-term view and work hard to maintain our reputation as an industry standout.

For the first six decades, the company name was Williams Brothers, changing to The Williams Companies, Inc. in the 1970s. Today, we go by Williams.

Here are some of the highlights along the way:

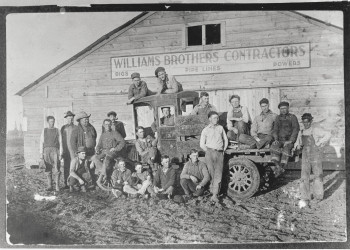

- 1908. Two brothers, Miller and David Williams, started a construction business in Fort Smith, Arkansas. Within a few years, they began building cross-country pipelines. In this fledgling industry, the Williams brothers earned a reputation for doing a good job on time and on budget.

- 1918. The business was moved to its current-day headquarters location Tulsa, Oklahoma.

- 1923. The brothers began building pipelines internationally.

- 1943. The company supported the U.S. war effort by building two critical pipelines, helping ensure the continuity of fuel to the East Coast.

- 1957. The company traded publicly as an over-the-counter stock.

- 1966. Williams bought a pipeline in what was the largest leveraged buyout that Wall Street had ever seen, beginning its transformation from builder to owner and operator of large pipeline systems.

- 1970s. As a conglomerate with businesses ranging from fertilizer and steel to retail stores and commercial real estate development, Williams turned its full focus back to energy and pipelines.

- 1983. The purchase of Northwest Energy Company was the beginning of the company’s nationwide system of interstate natural gas pipelines.

- 1985. The WilTel venture began, playing a foundational role in today’s digital world by using retired-from-service pipelines as conduit for fragile fiber-optic cable.

- 1995. The acquisition of Transco Energy Company expanded Williams’ natural gas transportation system to the East Coast and established the company as one of the nation’s largest-volume transporters of natural gas, now delivering about half of the natural gas consumed in New York City.

- 1998. Williams merged with MAPCO, whose assets happened to include a pipeline that Williams built in 1960, during the heyday of its construction business.

- 2001. The company narrowed its focus back to energy, exited the telecommunications business, and acquired Barrett Resources, adding significant natural gas reserves, primarily in the western United States.

- 2003. The company executed a plan to rebuild its financial strength by focusing on core world-class natural gas assets, selling billions in assets and reducing long-term debt, earning Williams the title of “turnaround story of the sector” by Merrill Lynch. All while continuing to pay a quarterly dividend to common-stock shareholders, as it has done without interruption since 1974.

- 2007. The results of the company’s financial strengthening actions resulted in its return to investment-grade credit.

- 2009. Williams began investing to grow its business in the Marcellus producing area of the U.S. Northeast. Today, the company is one of the largest gatherers and processors of natural gas in the Marcellus and Utica shale-gas supply regions. It also continued to invest in expanding its Transco interstate natural gas pipeline system – the nation’s largest, and fastest-growing – to create access to the “best markets” to the north and south of the Marcellus and Utica supply areas.

- 2014. The acquisition of controlling interest in Access Midstream Partners L.P. added to Williams’ growth footprint in the Marcellus and Utica producing areas and in areas of the Mid-Continent and the West.

- 2014. The company placed into service Gulf Star Floating Production System to handle oil and natural gas in the eastern deepwater Gulf of Mexico.

- 2014. Williams placed Transco’s “Big Five” expansion projects into service, increasing capacity on the pipeline by 25%.

- 2017. Williams enters Colorado’s Denver-Julesburg Basin through the acquisition of Rocky Mountain Midstream.

- 2018. Williams acquires the remaining interest in Williams Partners.

- 2018. Williams places its Atlantic Sunrise project into full service. The Transco expansion connects abundant Marcellus gas supplies with markets in the Mid-Atlantic and Southeastern U.S.

- 2019. The Gulf Connector project was placed into service, adding additional capacity to directly serve global LNG export facilities.

- 2020. Williams forms New Energy Ventures team focusing on advancing innovative technologies, markets and business models.

- 2021. The company acquires Sequent Energy Management, accelerating Williams’ natural gas pipeline and storage optimization and marketing growth, and increasing Williams’ gas pipeline marketing footprint.

- 2023. The company became the first large-scale midstream company in the U.S. to join OGMP 2.0, an international methane emissions reporting initiative.

- 2023. Williams acquires MountainWest natural gas transmission and storage business, expanding Williams’ services to key Rockies markets, including natural gas delivery into Salt Lake City and other demand markets not previously served by Williams.

- 2024. Williams acquires portfolio of natural gas storage assets from an affiliate of Hartree Partners LP. The transaction includes six underground natural gas storage facilities in Louisiana and Mississippi, as well as 230 miles of gas transmission pipeline and 30 pipeline interconnects to attractive markets, including LNG markets, and connections to Transco.