As part of our strategy to accelerate the next generation energy marketplace, Williams’ Corporate Venture Capital (CVC) program is investing in innovations at the forefront of the energy transition.

CVC enables Williams to stay on the leading edge of emerging trends and invest in startups to obtain a competitive advantage by integrating new technologies to access evolving energy markets. Since establishing the CVC, Williams has committed approximately $40 million toward venture funds and emerging technology companies. In addition, the company is evaluating over 90 startups for investment consideration.

Leveraging its large-scale energy infrastructure with innovations and emerging technology will enable Williams to better serve the clean energy needs of its customers for generations to come.

The objectives of the Williams CVC program are to:

- Advance natural gas as a fuel of choice through decarbonization pathways and transparency of emissions

- Adapt and build critical transport, storage and delivery infrastructure that support the clean energy future

- Pursue seed-to-early growth stage direct investments for which Williams’ assets and capabilities complement the investment

- Join other investors for rounds in which commercial relations will be formed and external expertise leveraged

- Manage risk exposure by investing in multiple ventures that create a balanced portfolio of direct energy transition investments

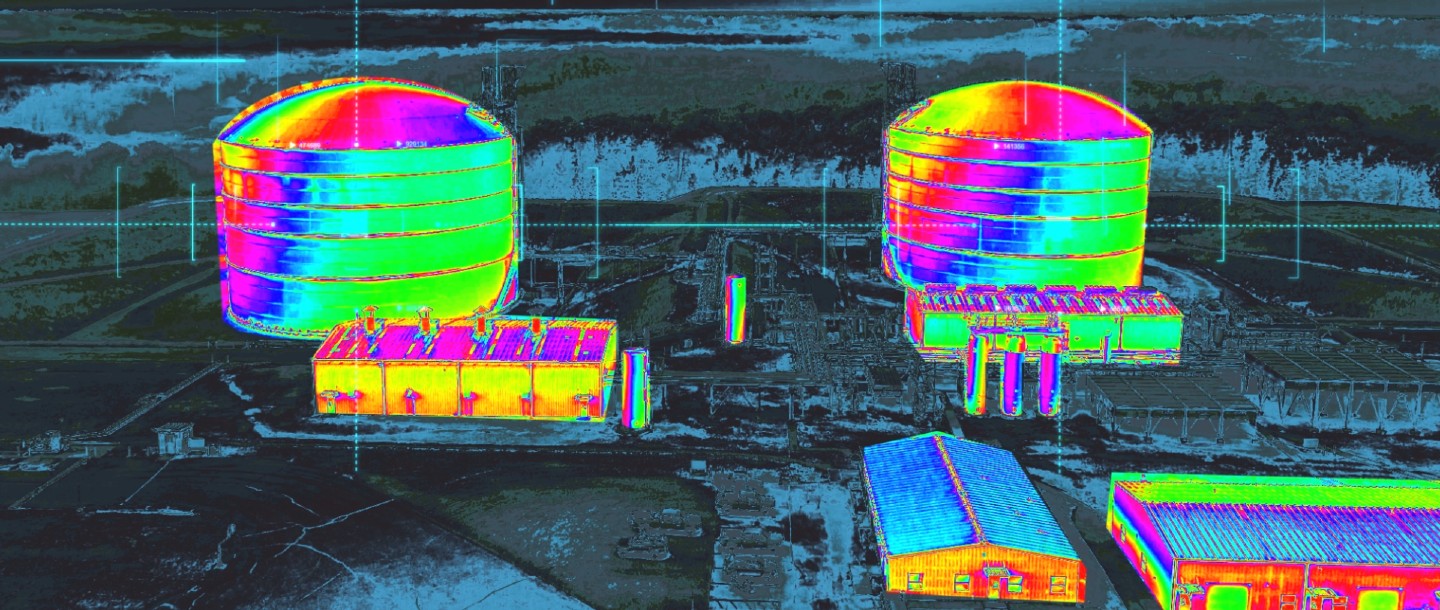

Williams recently used CVC funds to facilitate a partnership with data software company, Context Labs, to activate technology to enable Williams to offer differentiated services to its customers across the entire natural gas value chain. The initiative will overlay satellite monitors and blockchain technology on our core infrastructure to provide end-to-end measured, verifiable and transparent emissions data for real-time decision-making capabilities for Williams and our customers.

In a related effort, Williams has committed to an indirect investment in a developer of satellite-based greenhouse gas (GHG) monitoring technology. The investment in Satlantis Technology through our Encino Environmental Holdings joint venture will further enhance emissions detection and measurement capabilities, and feed data into the decarbonization software provided by Context Labs.

Separately, Williams committed $25 million toward two funds managed by Energy Impact Partners (EIP), a global venture capital firm that invests in venture and growth companies that are optimizing energy consumption and improving sustainable energy. Williams is among the first midstream investors in the EIP platform which it expects will facilitate diverse investment opportunities that reduce emissions and advance company ESG goals.

The CVC program is an outgrowth of Williams’ New Energy Ventures, a business development group focused on commercializing innovative technologies, markets and business models that include clean hydrogen, solar, carbon capture utilization and storage (CCUS) and NextGen Gas.

ESG

New technology to certify and optimize clean energy delivery

Williams will use a new technology solution to support the gathering, marketing and transporting of responsibly …

ESG

Investing in critical climate solutions

Williams is pursuing sustainable investment opportunities with Energy Impact Partners (EIP), a global venture …